salt lake county sales tax rate

The December 2020 total local sales tax rate was also 7250. You can print a 775.

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Notice of Value Tax Changes will be sent from the Auditors office by mid-July.

. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. As far as all cities towns and locations go the place with the highest sales tax rate is Salt Lake City and the place with the lowest sales tax rate is Bingham Canyon. Avalara provides supported pre-built integration.

The latest sales tax rate for Salt Lake City UT. What is the sales tax rate in Salt Lake City Utah. The current total local sales tax rate in North Salt Lake UT is 7250.

To find out the amount of all taxes and fees for your. Auditors office will start accepting property valuation appeals August 1 through September 15 2022. Property taxes are levied at the state and local level based on assessed valuations established by.

The Salt Lake Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax and a 080. The December 2020 total local sales tax rate was also 7250. If you would like information on property.

2020 rates included for use while preparing your income tax. The certified tax rate is the base. Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum. The Auditors office calculates certified tax rates for all entities in the county that levy property taxes. Salt Lake County Assessors Office provides the public with the Fair Market Value of real and personal property through professionalism efficiency and courtesy.

The most populous zip. Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax. The Salt Lake County sales tax rate is.

This rate includes any state county city and local sales taxes. Has impacted many state nexus laws and sales tax collection. Puerto Rico has a 105 sales tax and Salt Lake County collects an.

The current total local sales tax rate in Salt Lake County UT is 7250. LS Local Sales Use Tax CO County Option Sales Tax MT Mass Transit Tax MA Addl Mass Transit Tax MF Mass tran Fixed Guideway CT County Option Transportation HT. Average Sales Tax With Local.

93 rows This page lists the various sales use tax rates effective throughout Utah. Welcome to the Salt Lake County Property Tax website. Utah has state sales.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax.

This is the total of state county and city sales tax rates. The 2018 United States Supreme Court decision in South Dakota v. Property Tax Rates Salt Lake Citys general property tax rate is 015288.

272 rows 2022 List of Utah Local Sales Tax Rates.

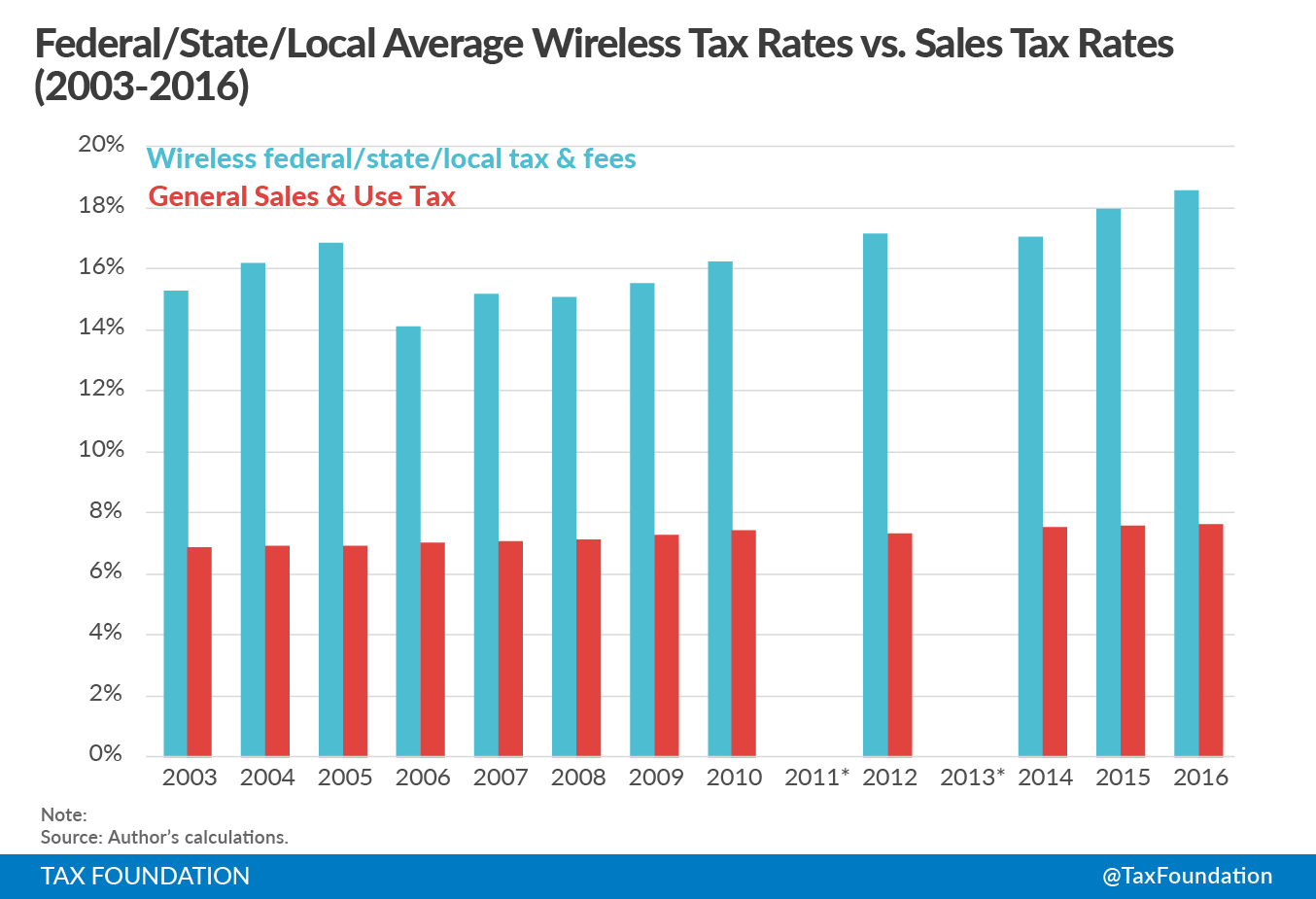

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

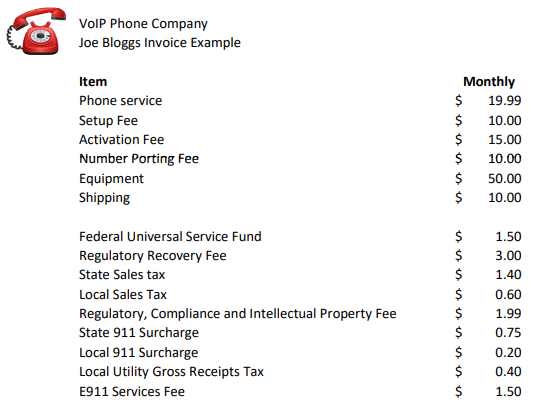

Voip Pricing Taxes And Regulatory Fees Explained

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah

File Sales Tax By County Webp Wikimedia Commons

What Renters Should Do Now Before Purchasing A Property Estate Tax Property Tax Tax Deductions

Utah Sales Tax On Cars Everything You Need To Know

Utah Sales Tax Small Business Guide Truic

Cell Phone Tax Wireless Taxes Fees Tax Foundation

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Salt Lake City Utah S Sales Tax Rate Is 7 75

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Utah Sales Tax Information Sales Tax Rates And Deadlines

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings